المنتديات

Welcome to the Internet frontpage discussion billboard, the best place to discuss topics with other users ranging from marketing, technology, health, beauty, entertainment etc.

Binary Options vs Forex vs Crypto Trading: Which Market Should You Trade in 2025?

Explore the differences between binary options, forex, and crypto trading in 2025. Learn which market fits your goals and risk appetite with a clear comparison and practical trading tips.

Introduction

In 2025, financial markets have never been more accessible.

From your smartphone, you can trade currencies, speculate on crypto volatility, or make lightning-fast binary option bets. But with so many possibilities, one question keeps surfacing: which market is best for you — binary options, forex, or crypto trading?

This comprehensive guide breaks down each market in detail, compares their structures, risk levels, and profit potential, and helps you identify which suits your goals.

You’ll learn how each market works, where they differ, and what it takes to succeed as a beginner or intermediate trader.

1. Understanding Each Market

1.1 Binary Options

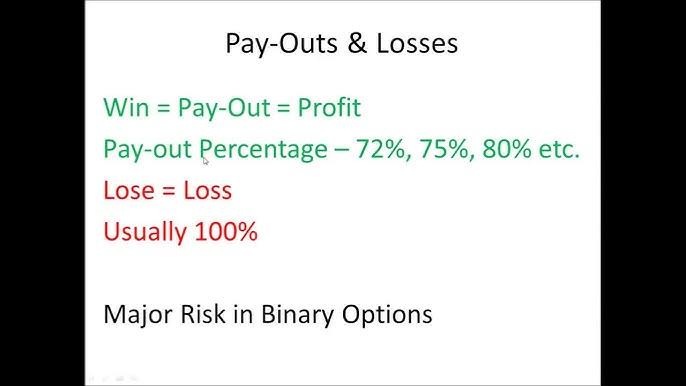

Binary options are a simplified form of trading. You predict whether an asset’s price will be above or below a specific level at a certain time. If your prediction is correct, you earn a fixed payout — usually between 70% and 90%. If not, you lose the invested amount.

This “yes/no” structure makes binary options easy to understand but deceptively risky.

Key characteristics:

-

Outcome: All-or-nothing (fixed payout or total loss)

-

Expiry time: From 30 seconds to several hours

-

Underlying assets: Currency pairs, commodities, indices, crypto

-

Leverage: None (fixed risk per trade)

-

Regulation: Highly restricted in the EU, UK, and some other regions due to misuse by unregulated brokers

Advantages

-

Simple concept — no need to manage leverage or margin

-

Defined risk and reward before entry

-

Quick results

Disadvantages

-

High risk due to broker bias or pricing opacity

-

Short-term nature encourages gambling behavior

-

Limited profitability potential

1.2 Forex Trading

Forex (FX) trading is the global marketplace for exchanging one currency for another. With over $7 trillion traded daily, it’s the largest and most liquid market in the world.

Key characteristics:

-

Instruments: Currency pairs (e.g., EUR/USD, GBP/JPY)

-

Trading hours: 24 hours a day, 5 days a week

-

Leverage: Typically up to 1:30 (retail) – 1:500 (pro)

-

Participants: Banks, institutions, hedge funds, and retail traders

-

Platforms: MT4, MT5, cTrader, etc.

Advantages

-

Deep liquidity – tight spreads and reliable pricing

-

Mature regulation across major markets

-

Scalable – works for scalpers and swing traders alike

-

Massive educational ecosystem

Disadvantages

-

Requires skill in technical and fundamental analysis

-

Volatility can spike during news events

-

Leverage amplifies both profits and losses

1.3 Crypto Trading

Crypto trading revolves around buying, selling, or speculating on the price movements of digital assets like Bitcoin and Ethereum. The market is open 24/7, unbound by traditional financial hours, and known for extreme volatility.

Key characteristics:

-

Assets: Coins, tokens, stablecoins

-

Trading hours: 24/7 globally

-

Volatility: High – daily swings of 5-20% are common

-

Leverage: Up to 1:100 on derivative exchanges

-

Regulation: Still developing and varies by country

Advantages

-

Round-the-clock market access

-

Potential for large gains on trends

-

Blockchain-based transparency

Disadvantages

-

Extreme volatility = high risk

-

Regulatory uncertainty

-

Exchange hacks or wallet security issues

2. Comparative Analysis: Binary vs Forex vs Crypto

| Feature | Binary Options | Forex Trading | Crypto Trading |

|---|---|---|---|

| Market Hours | Typically 24/5 | 24/5 | 24/7 |

| Volatility | Moderate | Moderate–High | Very High |

| Regulation | Tight/Restricted | Well Regulated | Evolving |

| Leverage | None | Yes (1:30 – 1:500) | Yes (up to 1:100) |

| Complexity | Low | Medium | Medium–High |

| Liquidity | Moderate | Very High | High |

| Risk Level | High | Medium | Very High |

| Profit Potential | Limited (fixed return) | Scalable | High (but volatile) |

| Ownership | No | No (CFD or spot) | Yes (actual coins) |

Summary:

-

Binary options are simplest but least transparent.

-

Forex offers balanced opportunity – regulated, liquid, and strategic.

-

Crypto delivers high reward potential with extreme risk.

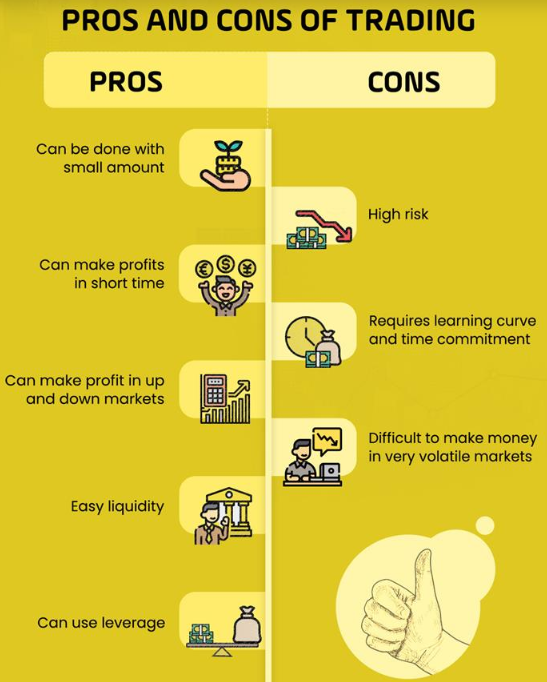

3. Pros and Cons of Each Market

Binary Options

Pros:

-

Simple decision process

-

Fixed risk per trade

-

Low capital requirement

Cons:

-

Often unregulated or restricted

-

Difficult to sustain profitability long-term

-

Temptation toward high-frequency “betting”

Forex Trading

Pros:

-

Global liquidity ensures smooth execution

-

Regulated brokers and transparent pricing

-

Wide variety of strategies (scalping, swing, position)

-

Predictable macro-economic influences

Cons:

-

Steeper learning curve

-

Leverage can magnify mistakes

-

Requires discipline and emotional control

Crypto Trading

Pros:

-

24/7 market access

-

Potential for exponential gains

-

New asset classes (DeFi, NFTs, altcoins)

Cons:

-

Volatility can wipe out accounts quickly

-

Technology/security barriers for newcomers

-

Unclear global regulation

4. Which Market Should You Choose?

Choosing depends on your risk appetite, capital, and time commitment.

| Trader Type | Best Market | Reason |

|---|---|---|

| Beginner with small capital | Forex | Lower volatility and high education resources |

| Short-term speculator | Binary Options | Quick outcomes and defined risk |

| High-risk tech-savvy trader | Crypto | Volatility and innovation |

| Strategic swing trader | Forex or Crypto | Opportunities for trend riding |

Use this quick checklist:

✅ How much time can you spend daily?

✅ How much volatility can you handle emotionally?

✅ Do you prefer analysis or quick predictions?

✅ Are you comfortable managing digital assets?

5. Practical Strategies for Each Market

Binary Options Tips

-

Use timeframes > 5 minutes to avoid noise.

-

Always trade on regulated platforms (CFTC- or EU-licensed).

-

Limit risk to 1-2% of capital per trade.

Forex Trading Tips

-

Focus on major pairs (EUR/USD, USD/JPY, GBP/USD).

-

Combine technical and fundamental analysis (news calendar).

-

Learn risk management: 1:2 risk-to-reward ratio minimum.

-

Use demo accounts before live trading.

Crypto Trading Tips

-

Choose reputable exchanges (Binance, Coinbase, Kraken).

-

Avoid overleveraging futures positions.

-

Diversify between coins and stablecoins.

-

Use hardware wallets for security.

6. Risk and Regulation in 2025

Binary Options: Still tightly controlled in the EU and UK. Only trade on regulated exchanges like Nadex or CFTC-approved venues.

Forex: Well regulated globally (FCA, ASIC, CySEC, NFA). Retail traders should stick to licensed brokers.

Crypto: Regulatory landscape evolving rapidly — more governments introducing stablecoin rules and exchange licensing. Stay updated on regional laws.

7. Final Comparison Snapshot

| Aspect | Binary Options | Forex Trading | Crypto Trading |

|---|---|---|---|

| Skill Required | Low | Medium | Medium–High |

| Risk Profile | High | Medium | Very High |

| Accessibility | High (online) | High | High |

| Return Potential | Limited | Scalable | Unlimited (but volatile) |

| Learning Resources | Moderate | Extensive | Growing |

Conclusion

Each market offers unique opportunities and risks:

-

Binary Options are simple but high-risk, best for short-term speculation on regulated platforms.

-

Forex is the most balanced choice for beginners and intermediates seeking scalable growth within regulated markets.

-

Crypto Trading delivers massive potential but demands discipline, research, and risk management.

No single market is “best” for everyone — success depends on your strategy, education, and consistency.

Start with a demo account, learn the mechanics, and develop a risk-based plan before committing real capital.